|

|

Retail Update - September 2018 |

| |

Posted At: 24 September 2018 00:16 AM

Related Categories: General, Retail Statistics, Retailers |

| |

Continuing the pattern of the year, the retail world is still a bit gloomy.

The high street continues to suffer retail losses, as Faucet Inns’ Nordic-inspired restaurant group KuPP entered in to administration with the closure of two sites, and Saltrock Surfwear was acquired by Crew Clothing in a pre-pack deal saving 25 stores. Many other retailers teeter on the edge, not helped by the anticipated rise in business rates that is to come.

However, as the summer sun gives into autumn, there is some better news to be had;

-

Instagram has unveiled two updates to its retail offer: expanding the Shopping function into Stories and introducing Shopping to the Explore tab, helping to fuel online shopping

-

According to Visa UK’s Consumer Spending Index, household spending rose 0.4% in August up from a 0.9% drop a in July, buoyed by back to school spending and continued good weather

-

The restaurant industry is starting to pick up once again after a troublesome two months of extreme hot weather led to dwindling sales, according to Coffer Peach Business Tracker analysis. Collective like-for-likes at managed pubs, the main benefactors of the warm climate, rose by 0.2% against August last year. Meanwhile restaurants experienced a year-on-year uptick of 1.4%

-

The UK womenswear market grew by 3.2% to £28.4bn in 2017 according to a research by Mintel, which surveyed over 1000 female shoppers from the UK aged 16 or more. Mintel also forecasts British women to spend £29.4b in clothing this year, and the sales of womenswear to grow by 14% between 2018 and 2022

-

The government has decided to adopt ‘Agent of Change’ principles into planning legislation in a move that will support longstanding bars, pubs and clubs facing noise complaint issues from new developments in their area

-

New findings from Ipsos show that more overseas shoppers buy from the UK than any other European country. “Cross-border merchant research” on behalf of payment provider PayPal found that 14% of global online shoppers had bought from the UK in the last 12 months, making the UK the largest online exporter in Europe

And finally, three out of four retail transactions are now made by card according to new data from the British Retail Consortium. Its latest annual Payments Survey reveals that more than three quarters of transactions now are made digitally. Cash payments dropped by 1% year-on-year, now accounting for just 22% of the UK’s total retail sales, which rose 4.3% to £366bn in 2017.

|

|

|

|

Retail Update - June 2018 |

| |

Posted At: 19 June 2018 16:16 PM

Related Categories: General, Retail Statistics |

| |

Much like last month, and certainly since the beginning of the year, the retail world is still rather gloomy.

Retail space equivalent to 180 football pitches has been handed back to landlords as the high street continues to struggle. An analysis by property consultancy Colliers International shows 11.6m sq ft of retail space has been “lost” through administrations, company voluntary arrangements (CVAs) and planned store closures this year.

However, there is some better or interesting news if you look hard enough for it.

-

Hot weather in May helped boost trade in Britain’s pubs but hit restaurant sales. While managed pubs saw collective like-for-likes jump 3.5% in May, with drink-led outlets doing best, casual dining brands saw like-for-like sales drop 2.1%, according to latest figures from the Coffer Peach business tracker

-

Debit cards have overtaken cash as the preferred method of payment in the UK for the first time according to new figures from UK Finance. UK consumers made 13.2 billion debit card payments in 2017, compared to 13.1 billion cash. Two-thirds of UK shoppers now use contactless payments to buy goods

-

Vacancy rates in the UK’s out of town retail sector remain low with Savills’ research showing just 5.96% of units currently unoccupied. This is significantly lower than the sector’s 10.86% vacancy rate by unit in 2015 and 12.17% in 2012

-

Instagram is expanding its shopping function to Instagram Stories following the UK launch of Instagram Shopping in March. On Instagram Stories shoppers will be able to tap on a sticker of a shopping bag icon to see more details about that product and seamlessly shop the item

-

The British Property Federation (BPF) is demanding an urgent government review of the Company Voluntary Arrangement (CVA). The industry body said the CVA process is now being 'mis-used', which risks undermining the UK’s global reputation and deterring much-needed investment into town and city centres

-

Menswear continues to outperform womenswear, growing by 3.5% in 2017 to reach a value of £15bn, according to Mintel, and now accounts for 26% of the total clothing market. The womenswear market is valued at £28.4bn

-

The UK convenience market is forecast to grow by 17.6% in value between now and 2023, while the value of online will surge by more than 50%, according to new IGD research. The overall food and grocery market is predicted to grow by 14.8% to £218.5bn over the five-year period, with growth forecast for all channels

|

|

|

|

Retail Update - April 2018 |

| |

Posted At: 24 April 2018 00:20 AM

Related Categories: General, Retail Statistics, Retailers |

| |

With the sun now shining we are expecting a light at the end of this gloomy tunnel, but for now, we’re still seeing what seem to be almost weekly reports of another CVA. Coupled with the Beast from the East hitting footfall and retail sales harder than expected, and retail profit warnings rocketing to a seven-year high in the first three-months of the year, that light still seems some way off.

Amongst the doom and gloom, there is some better or interesting news if you look hard enough for it.

-

Consumer confidence grew in March, thanks to overall economic growth and prospects of wage increases “finally” outstripping inflation. Overall shopper sentiment climbed three points to -7 this month, according to GfK data

-

Amazon is now the fifth biggest retailer in the UK accounting for £4 in every £100 spent in retail in the UK last year

-

Savills research has found overseas expansion of luxury brands spurred on Europe’s leasing activity in the global luxury retail market, with London and Paris leading the way. US retailers with aggressive expansion programmes were behind the growth, up from 36% in 2006 to 38% in 2018

-

The Future of Fulfilment Vision Study from Zebra Technologies forecasts that same-day delivery will be the norm by 2023, and also suggests a significant minority foresee two-hour delivery by 2028

-

There was a net increase of 16 bakery stores in 2017, with 76 sites opening and 60 closing. Cafes and tearooms recorded one of the strongest performances, with a net increase of 30 stores

-

Restaurants and pubs continued to outshine other sectors in March with year-on-year growth rising by 7.2% and 7.7% respectively according to Barclaycard data

-

European consumers spent 4.4% more on groceries in the last quarter of 2017, making it the biggest increase in six years, according to new figures from Nielsen. whose retail performance data figures covered 21 European countries

-

Online retail sales made via smartphones grew 18.9% year-on-year in December 2017, while sales on the device increased from 36% to 41% between 2016 and 2017. In contrast, the research from online retailer Mobiles.co.uk found desktop orders fell from 47% to 45% year-on-year in December 2017 and tablet sales decreased from 17% to 14% during the same period

|

|

|

|

Retail Update - March 2018 |

| |

Posted At: 23 March 2018 16:00 PM

Related Categories: General, Retail, Retail Statistics |

| |

2018 is proving to be a difficult year so far for retail, with not much improvement on the gloomy landscape since our last update and high-profile administrations including Toys R Us, Maplin and Countrywide Stores, and a number of CVAs also approved. The news that over a quarter of the UK’s largest retailers are loss-making does not paint a rosy future.

However, there is some good or interesting news if you look hard enough for it.

• Retail sales showed surprising growth according to the ONS, with retail sales volumes up 1.5%, ahead of predictions

• UK inflation fell to 2.7% in February with a slow-down in food and transport price increases named as the largest downward contributors

• More retailers are jumping on the bandwagon of ‘try-before-you-buy’ for online shoppers

• IGD forecasts that the European grocery retail market is set to achieve sales of €2,289bn by 2022, driven by growth in central and eastern Europe

• Instagram has unveiled its much-anticipated shopping update, allowing UK businesses to sell products via posts

• Research has revealed that consumers are willing to pay up to £1.25 more for a burger if it comes in a gourmet bun, a study by Lantmannen Unibake showed

• The restaurant and bar scenes in Liverpool, Manchester and Leeds are growing at double the rate of that in London

• Pubs continued to prove resilient to industry pressures in February achieving a 1.3% increase in like-for-like sales compared to a 1.5% decline seen in restaurants. However, the Coffer Peach Business Tracker has shown that people continued to dine out in February despite the cold weather and negative media coverage around high-profile casual dining brands closing sites

• Data from online retailer OnBuy shows the North West, West Midlands and Scotland had the highest rate of independent store openings in the UK in 2017 – with 230, 194 and 114 independent openings respectively

• Chinese tourist spend on shopping in the UK has risen by almost a third. Figures from the UK China Visitor Alliance show numbers of Chinese visitors to the UK soared by over 150% in the five years since 2012, from 211,000 visitors to 532,000 in 2017

And finally, a new study has found that Brits have collectively blown £4.46bn on spontaneous purchases while under the influence of alcohol, with almost half of British adults – 45.8% or around 15 million people – confessing to making a purchase while under the influence. Finder’s new report, which surveyed 2000 adults, also revealed that the average spontaneous spend while drunk shopping was a whopping £291.07 each!

|

|

|

|

Retail Update - February 2018 |

| |

Posted At: 20 February 2018 17:15 PM

Related Categories: Administrations, Retail Statistics, Retailers |

| |

The start of 2018 has been a rocky one for retail.

• Restaurant insolvencies increased by 20% in 2017 with 984 entering administration, up from 825 in the previous year, according to accounting and advisory network Moore Stephens, who also said the last 10 years have seen an “unprecedented” level of openings creating an “over restauranted” market

• January saw a raft of closures among both casual dining and independent restaurants, including a CVA of Jamie’s Italian and Byron and the administration and subsequent closure of Square Pie

• The latest figures from the Coffer Peach Business Tracker show Britain’s managed-pub and restaurant chains saw collective like-for-like sales 0.6% ahead in January despite widespread doom and gloom

• Similarly, nearly a fifth (19%) of clothing retailers in the UK are showing “early warning signs” that they are at risk of going insolvent, according to Moore Stephens. Out of 35,078 fashion retailers, 6,580 were found to show early signs of financial distress, such as a large fall in revenue or poor payment history

• According to the latest data from Kantar Worldpanel, total physical entertainment sales dropped 8.8% in the 12 weeks to January 14, with video dragging down the average with a 21% drop. Physical music sales also saw a decline of 5.8% but the resurgence of vinyl sales helped offset the decline - now accounting for 10% of physical music sales

• Sales across UK retailing have been largely flat in January, the latest ONS figures show

• Ecommerce saw a slowing in growth from 19.1% this time last year to 9%, accounting for 16.5% of all retail sales, down from 18% in December

• According to the annual ‘Shopper Stock Take’ report from Shoppercentric, shoppers are adjusting their buying habits – over a quarter (26%) of UK shoppers report having noticed prices increasing a lot, while 56% say they have seen small spikes. Consumers primarily put these increases down to the state of the economy (54%) and Brexit (50%), although the exchange rate, cost of ingredients and ‘greedy’ companies are also blamed by a fair proportion of shoppers

What remains to be seen is how the rest of the year pans out – FSP and SnapShop are on hand to keep you up-to-date and provide assistance to you and your centres.

|

|

|

|

Retail Update - January 2018 |

| |

Posted At: 22 January 2018 10:22 AM

Related Categories: Retail, Retail Statistics, Retailers |

| |

So Christmas has been and gone, delivering a mixed bag of results across the retail sector as evidenced in our Christmas Sales report, and highlighting those retailers that are teetering on the edge.

It’s not all doom and gloom, however.

2017 saw the UK entertainment retail market sales hit record highs in 2017 outpacing the wider UK economy by more than four-fold. According to the latest figures from the Entertainment Retailers Association (ERA), which combines music, film and video games, sales grew 8.8% to £7.24 billion last year, marking the fifth successive year of growth. This “historic” growth is down to the growing presence of digital services like Spotify and Amazon, accounting for more than 70% of entertainment sales values during the year.

The coffee shop market also had a good 2017. Store openings contributed to 7.3% hike in turnover to £9.6bn across the category in 2018 according to Allegra World Coffee Portal in its Project Café 2018 UK study. Over the year, 1,215 openings took the total number of stores to 24,061. Branded chains accounted for 10.5% of the sales growth, with combined revenue of £4bn. Costa, Starbucks and Caffe Nero continue to dominate the market, and together make up 52.9% of the total branded chain market.

So what does 2018 hold?

With December seeing falling retail sales as a result of Black Friday bringing Christmas sales forward, footfall decreasing during the month and consumer confidence dropping by one point, 2018 could, perhaps, see the retail market get worse before it gets better. Retailers are going to have to innovate and make the latest advances in technology work for them to entice shoppers to part with their cash and visit their shops, rather than shopping solely online; and landlords are going to have to get their tenant mix right to ensure they are catering for the needs of their local shoppers and visitors alike.

FSP can help with location strategies and tenant mix strategies. Contact us to find out how.

|

|

|

|

Retail Update - October 2017 |

| |

Posted At: 20 October 2017 14:12 PM

Related Categories: Retail Statistics, Retailers |

| |

FSP’s SnapShop brings you a snapshot of the UK retail environment for the last month.

-

September saw administrators appointed to Basler, Greenwoods Menswear and Just For Pets. Of the three, Just For Pets has been subsequently rescued by Pedigree Wholesale

-

September’s online retail sales recorded the third-strongest growth rate so far this year, up 14% year-on-year, according to the latest figures from the IMRG Capgemini e-Retail Sales Index

-

Almost half of consumers (48%) aged 25-34 find location-based marketing appealing, according to a survey by Hammerson. Interestingly, women and young customers are most receptive to new forms of marketing technology, including personalised promotions, virtual reality and virtual mirrors

-

Pubs, bars and restaurants in the UK saw like-for-like sales fall 0.9% in September as consumers rein back on spending, the Coffer Peach Business Tracker reported

-

High street footfall was in decline for a third consecutive month throughout September, dropping 1.2% according to Springboard and the British Retail Consortium

-

A record 39.7 million visits from overseas are forecast to takes place this year, up 6% from 2016 – largely driven by the 16% fall in the value of the pound. The figures, which also outlined that spending during 2017 is expected to increase 14% year on year to £25.7m, were announced in the VisitBritain/VisitEngland annual review

-

Around £10bn is expected to be spent through mobile devices in November as UK retailers prepare for the Black Friday shopping event, figures from Salmon suggest. The majority of online orders were made via mobile on Black Friday (51%) last year

|

|

|

|

Retail Update - September 2017 |

| |

Posted At: 20 September 2017 15:26 PM

Related Categories: Retail, Retail Statistics, Retailers |

| |

FSP’s SnapShop brings you a snapshot of the UK retail environment for the past month:

-

Young fashion brand Rare London ceased trading in August following the appointment of administrators

-

August retail sales smashed expectations, with overall growth of 1% between July and August according to the ONS – well above the consensus forecast of 0.2%

-

According to the IMRG Capgemini Online Retail Sales Index, UK online sales grew by 16.4% in August. Average basket values were the highest seen in August for five years, reaching £130

-

Latest research by GlobalData predicts that clothing and footwear will drive 35% growth in the UK online market, to reach £69bn by 2022. Mobile spend is also expected to jump 112% in the next five years

-

Second-hand retail is on the rise. According to Ibis World the second-hand market accounts for around 14% of London’s retail establishments, and sales volumes across the industry grew over 5% last year

-

GfK’s Consumer Confidence Index rose two points in August, compared to the July’s one-year low

-

Latest figures from The Department for International Trade reveal that UK fashion exports rose to a record £10.7bn in 2016, with an 8% rise in exports of footwear, clothing and textiles compared with the previous year. The US, Hong Kong and Australia in particular snapped up more than £1bn in UK exports

|

|

|

|

Retail Update - August 2017 |

| |

Posted At: 18 August 2017 00:33 AM

Related Categories: Retail, Retail Statistics, Retailers |

| |

FSP’s SnapShop brings you a snapshot of the UK retail environment for the past month:

-

July saw the demise of Chicago Rib Shack after it struggled with a lack of working capital; the chain was subsequently rescued by the entrepreneur behind the Camden Dining Group

-

The month also saw the weakest reading in consumer confidence since just after the Brexit vote, dropping two points to reach -12 in GfK’s Consumer Confidence Index. Excluding the post-referendum dip in July 2016, the index hasn’t been this low since 2013

-

Online retail sales grew by 11% in July, representing the slowest growth for the month since July 2013 according to the latest IMRG Capgemini e-Retail Sales Index. So far in 2017, online sales have grown by 12%

-

British Land research has revealed a symbiotic relationship between physical stores and ecommerce. The research, using data from Connexity Hitwise, shows that when a new store opens, traffic to the retailer’s website from the surrounding postal area increases by 52% on average within six weeks of opening. And digital traffic from the local area then remains around this level, demonstrating that a physical store has a significant, positive and sustained impact on digital interaction with the brand

-

The UK sports clothing market is expected to climb 8% to £2.5bn this year according to GlobalData, as the athleisure trend continues to grow. Customer demand following 'high profile attention via Instagram influencers' has driven fashion retailer investment in sportswear

-

UK consumers made nearly 1.4 billion card payments in June, an increase of 12% on the same month last year and the highest growth rate since 2008, according to new figures from UK Finance. Contactless payments accounted for 34% of all card transactions, while online payments made up 13%. There are calls to increase the spending limit on contactless cards

-

The KPMG/Ipsos Retail Think Tank said that the health of Britain’s retail industry had fallen in the second quarter and was likely to drop even further in the third quarter. It said that if this were to happen, it would represent three consecutive quarters of negative performance “which is something that has not happened since 2012”

|

|

|

|

Retail Update - July 2017 |

| |

Posted At: 25 July 2017 14:42 PM

Related Categories: Retail, Retail Statistics |

| |

The past month on the high street has seen Handmade Burger Company fall into administration and close nine of its stores, and, not surprisingly, Store Twenty One collapse into liquidation, with the subsequent closure of its remaining 122 shops.

Retail sales in June have driven a “renewed sense of optimism” for the UK economy, showing promising recovery from last month’s four-year low. The latest figures from the Office for National Statistics (ONS) revealed that sales volumes jumped 1.5% in the three months to June, rising significantly from the 1.4% drop seen in the prior quarter.

Couple this with a prediction from Worldpay that overseas visitors could spend as much as £2.4bn in a spending bonanza by the end of this summer as they take advantage of sterling’s weakness, and all is not looking too gloomy on the high street.

According to CBRE’s bi-annual Global Prime Retail Rents report, New Bond Street has been revealed as the second most expensive retail location in the world, seeing a huge 39.1% increase in prime rental growth in the first quarter compared to the same period last year to give it an average annual rent of £1345 per sq. ft. New York retained its top spot, with Fifth Avenue almost doubling the sq. ft. value of New Bond Street with an average of £2487.52.

An interesting report, Retail Revolutions: The Rise of the Community Shopping Centre, has revealed that an increasing consumer focus on affordability and convenience has seen value and discount retailers increase their UK store count by more than 5000 since 2009. Value retail accounted for 87% of all store growth in the UK during that time. The report also said supermarket chains have increased their convenience offer with more than 1600 stores since 2009.

The online market continues on its steady march. According to new research from GlobalData, clothing and footwear is driving smartphone shopping in the UK – with the sector set to account for 42% of all smartphone spend by 2022. Its latest report says spend via smartphones will outperform spend via tablets to account for 51.5% of the UK mobile and tablet market in 2018 – and is set to grow 112% in the next five years. Key sectors aiding market acceleration via smartphone are clothing and footwear, which have the highest proportion of sales on these devices. However, food and grocery is expected to be the fastest growing sector in terms of sales via smartphone to 2022.

It will be interesting to see how the smartphone shopping trend continues and if this becomes the ‘new’ face of online shopping, as well as how the high street fares over the summer months. FSP aims to keep you up-to-date with all the latest news and trends.

|

|

|

|

Retail Update - June 2017 |

| |

Posted At: 16 June 2017 11:39 AM

Related Categories: Administrations, Retail, Retail Statistics, Retailers |

| |

May was a month of change on the high street. German womenswear brand Basler fell into administration; Joy was bought out of administration by its owners in a pre-pack deal; and Edinburgh Woollen Mill acquired the Jaeger name. Additionally, Edinburgh Woollen Mill embarked on a new department store concept, Days, which launched in a former BHS store in Carmarthen.

Household spending growth slowed in May as British shoppers selectively cut back purchases, as the rise of inflation threatens living standards. According to Barclaycard figures, spending was up 2.8% on the year, which marked the slowest rate of growth since last July. The British Retail Consortium’s (BRC) study of shops’ sales found growth slowed to 0.2% on the year, a substantial slowdown from the strong Easter spending in April.

The BRC’s Online Retail Sales Monitor also found that e-commerce sales grew at their slowest rate for more than four years in May. Online sales of non-food products grew by 4.3% in May – down from 13.7% a year earlier and at its lowest level since the BRC analysis started in December 2012. The three-month average stands at 7% – also the lowest the BRC report has yet recorded.

This slow-down both online and on the high street in May could have been the result of a pre-election and pre-Brexit blip. However, according to the long-running and closely-watched GfK Consumer Confidence Index, consumers’ confidence in May stood at -5, two points up compared to -7 in April, suggesting that this isn’t the case.

Interestingly, Payments UK – the trade association for the payments industry – has forecast that debit cards will overtake cash as Britain’s most frequently used method of payment by 2018 thanks to the rise in contactless cards. Worldpay, which handles 40% of all UK card transactions, said that spending on all forms of contactless systems now accounts for 28% of all non-cash transactions in the UK, with total spend exceeding £10b for the year in 2016.

However, the Bank of England’s chief cashier and director of notes has said cash payments were “very much alive and kicking” and that contactless and electronic payments were not a threat. Victoria Cleland highlighted how technology has had a “huge impact”, with ways to pay including digital currencies, mobile payments and innovations such as contactless cards gaining “real traction”. But contrary to predictions of the eventual death of cash, Cleland said “if we dig further, it is clear that cash is very much alive and kicking”.

|

|

|

|

Retail Update - May 2017 |

| |

Posted At: 19 May 2017 16:32 PM

Related Categories: Administrations, General, Retail Statistics |

| |

Following on from the administrations seen in March, April saw one high-profile retailer fall – that of Jaeger. Administrators announced the closure of 20 stores and the loss of 253 jobs shortly after Easter, and as yet, a buyer has not been found for the chain.

The high street benefitted in April from the late timing of Easter as evidenced by the figures from the Office for National Statistics. UK shoppers bought 2.3% more in April than they did in March. On an annual basis sales grew by 4%, helping to buoy the economy after a weak March - retail sales in the three months to April were up 0.3% compared with the previous three-month period. This suggests shoppers are not cutting back despite rising inflation, which climbed to its highest level in three and a half years to 2.7% in the 12 months to April, driven by the fall in the pound and consequent increase in the cost of imported goods.

E-commerce sales also grew by 19% in April, with shoppers collectively spending £1bn a week online during the month - accounting for 15.6% of all retail spending, excluding automotive fuel. That’s up from a 14% share last year.

Not surprisingly, footfall was also up in April. Figures from the British Retail Consortium and Springboard’s retail footfall monitor reveal that footfall in high streets was up 2.3% while footfall in retail parks climbed by 2.7%. However, footfall in shopping centres edged down 0.6%.

Continuing the Easter effect on the high street, figures from the Coffer Peach Business Tracker show that managed pub and restaurant groups were back in growth in April, with collective like-for-like sales up 4.4% compared with the same month last year.

In other news, the surge in openings of low-cost fitness clubs has driven gym usage in the UK to a record high. Memberships last year rose from 9.2 million to 9.7 million, boosting penetration from 14.3% to 14.9%, equivalent to one in seven people. According to the 2017 State of the UK Fitness Industry Report, the number of fitness facilities grew by 4.6% to 6,728 in the 12 months to the end of March. The number of budget gyms passed 500, with the sector now accounting for 15% of the market’s value but 35% of private sector memberships. The value of the market as a whole is estimated at £4.7 billion, up 6.3%, with the sector set to reach several milestones in the next 12 months: £5 billion by value, 7,000 gyms and 10 million memberships. All of which is good news for those involved in finding innovative use for retail space.

|

|

|

|

Retail Update - January 2017 |

| |

Posted At: 23 January 2017 00:17 AM

Related Categories: Retail Statistics, Retailers |

| |

2016 has certainly been a tumultuous year both in the UK and abroad, with major decisions having taken place surrounding the UK’s exit from the EU, and indeed the election of Donald Trump as US president. Both of which are likely to have significant impacts on the UK and the spending power of its consumers, but that remains a tale for this year as events surrounding both unfold over the forthcoming months.

2016 has had its highs and lows in retail; from the demise of BHS in May – the row over its administration still rumbles on as costs continue to escalate; to the launch of several new retailers and concepts in the UK – Duka, Griddle & Shake, Coffika, Typo, Ribs & Burgers, Jurlique and Maison Kayser to name a few; proving that the UK is still a great place to invest. Figures from Deloitte show that 92 retailers went into administration last year, down 4% on the 96 that failed in 2015.

Online sales soared in 2016 rising by 16%, fuelled by soaring mobile shopping rates and strategic Black Friday purchasing. Data from IMRG revealed that £133bn was spent online shopping in the UK during 2016, a 16% rise on 2015. This was boosted by a 47% rise in the number of transactions made by on mobile phones. However, sales via tablets fell by 3%. IMRG is forecasting a 14% growth in sales for 2017.

Consumers continued to spend out on leisure activities, resulting in the UK and Ireland cinema box office achieving its best-ever results in 2016, amassing £1.32bn to beat the previous record set in 2015. According to figures released by the box-office tracker comScore, the total for 2016 was 1.45% higher than the previous year, which finished at £1.31bn.

Entertainment retail sales also reached an all-time record high in 2016 as digital services like Spotify, Apple Music and Sky enhanced the industry. Figures from the Entertainment Retailers Association (ERA) show that entertainment retail sales reached £6.3 billion in 2016, up 3% on 2015 which was a 53-week year, and taking in over £1 billion more than in 2012. Digital sales of music, video and games encourage this growth, with the video market becoming a majority digital market for the first time. Non-physical sales also account for 57% of music revenues despite vinyl maintaining a healthy resurgence up 56.4% from 2015.

2017 certainly has a lot to live up to if it wants to surpass the records set in 2016. Whatever happens, you can be sure that SnapShop will keep you up-to-date.

|

|

|

|

Retail Update - March 2016 |

| |

Posted At: 29 March 2016 00:27 AM

Related Categories: Administrations, Retail Statistics, Retailers, Store Closures |

| |

The past month has seen a bit of turmoil on the high street, although no administrations have been recorded on SnapShop.

BHS proposed a CVA at the beginning of March which was subsequently approved this week to enable it to reduce rents in 40 loss-making stores as it looks to continue to trade through its turnaround plan.

Beales also filed for a CVA at the beginning of March for 11 of its 29 stores, seeking a rent reduction of 70% on 11 stores for 10 months while it negotiates with landlords. The other 18 stores – including its flagship in Bournemouth – are unaffected.

Recent weeks have seen plans to extend Sunday trading hours rejected by MPs, meaning that all will stay the way it has been on the high street. Many see this as a victory, while others see it as a disappointment. FSP can see both sides of the coin, and we wonder whether this is something that will be addressed again in the future as we move further into the digital world.

With the news that Google is bringing Adroid Pay to the UK soon, Barclaycard research has shown that contactless spending in 2015 soared by 188% in pubs and bars. The category experienced the third biggest rise in 'touch and go' transactions over the past year behind public transport (532%) and pharmacies (207%). Contactless spending in fast food outlets was also up 108%. Restaurants witnessed a 104% increase and caterers, ranking 10th on the list, saw a 96% uptake in the speedy payment method. This is definitely something to watch in the coming months.

Another addition to the ‘ones to watch’ list, is that a wave of American retailers is predicted to cross the pond and use London as a launch-pad into European expansion. Research from BNP Paribas has forecast that brands such as Michael Kors, America Eagle Outfitters, Henri Bendel and Tory Burch, as well as new market entrants, will be among the US retailers drawing up expansion plans, seeking to capitalise on the buoyant consumer environment in the UK.

|

|

|

|

Retail Update - February 2016 |

| |

Posted At: 24 February 2016 00:42 AM

Related Categories: Administrations, Retail, Retail Property, Retail Statistics |

| |

No administrations have been recorded on SnapShop since our last update.

Brantano, which was placed into administration in early January, was acquired by its former owner Alteri Investors in mid-February. Some 58 stores and concessions were not included in the Alteri acquisition. It will be interesting to see what happens with this retailer in the future, as it seeks to become more of a multichannel player with a slimmed down store portfolio.

The high street doesn’t seem to have been affected by the so-called ‘January Blues’ this year; indeed UK retail sales surged the most in more than two years in January, boosted by demand for clothing and computers. Pub and restaurant groups have continued their strong growth seen last year, with collective like-for-like sales in January up 1.9% on the same month last year, according to latest figures from the Coffer Peach Business Tracker.

A rather notable trend that emerged from 2015 was the soaring sale of gift cards. Figures from the Gift Voucher Shop, the company behind the One4all Post Office Gift Card, revealed a 35% increase in sales, online sales via One4allgiftcard.co.uk saw a 60% increase compared to 2014, and gift card orders for rewards and incentives via the corporate division, One4all Rewards, soared by 47% on the previous year.

According to the data, fashion retailers saw the largest value of One4all Gift Card redemptions during the 2015 Christmas period and overtook general merchandise stores which were number one in 2014.

FSP will be watching with interest as new trends emerge in 2016. Our understanding of retail helps our clients make informed investment, development and asset management decisions.

|

|

|

|

Retail Update - September 2015 |

| |

Posted At: 17 September 2015 11:34 AM

Related Categories: Retail, Retail Statistics |

| |

There have been no reported administrations since our last update. Quiksilver is the only company to have reported filing for bankruptcy in the US after losing 79% of its market value this year. Its operations outside the US are not part of the Chapter 11 filing. Quiksilver said the global investment lender, Oaktree Capital Management will provide the company with the $175m (£113.73m) it needs to restructure "and fund its ongoing operations in the US and abroad".

Despite online sales recording their weakest month of growth in August since November 2012, a new study from Webloyalty is predicting that by 2019, annual shopping via mobile will be worth as much as the amount spent in more than 30,000 UK shops. The research suggests that the m-commerce sector in the UK is currently worth £9.7 billion and is expected to grow to £53.6 billion by 2024. Spend on smartphones is forecast to rise by 243.5% in the next four years, with direct spend on both phones and tablets set to climb by over 230%.

It seems that with improving consumer confidence there are lots of forecasts predicting growth:

• The UK luxury sector, including designer apparel and footwear, is expected to be worth more than £51bn by 2019, the latest figures have revealed. The sector contributed £32.2bn to the economy in 2013, 2.2% of GDP, according to a study by international consultancy Frontier Economics for Walpole, the industry alliance whose members including Burberry, Alexander McQueen and Harrods, and law firm Charles Russell Speechlys. Luxury businesses are set to employ 158,000 people within the next four years, up from 113,000 in 2013, and grow in value by 60%.

• Similarly, the UK plus-size fashion market is set to hit the £5.4bn mark in 2015, accounting for 12.4% of the overall clothing market, according to research by Conlumino. Conlumino forecasts shoppers’ spend on plus-size fashion will grow 23.8% to £6.4bn by 2019 as more retailers expand their ranges to include bigger sizes.

You can keep up-to-date with the latest trends here on SnapShop.

|

|

|

|

Retail Update - February 2015 |

| |

Posted At: 25 February 2015 11:26 AM

Related Categories: Administrations, Retail, Retail Statistics, Retailers |

| |

FSP’s retailer database has recorded one administration since our January update, bakery retailer Cooplands of Doncaster. Cooplands underwent a pre-pack administration process which saw the closure of 39 stores and the loss of 300 jobs. ReSolve acquired the remaining 42 shops.

Given the trend for most retail failures to occur during the first quarter of the year, one administration in February isn’t bad going. We will wait to see what March brings.

Dubai-based vegetarian fast-food franchise Just Falafel closed down its UK operations this month following a change in the company’s overall direction and strategy worldwide, although the company has not ruled out a return to the UK market.

Highlighting the ever-changing ways consumers like to shop and the evolution of mobile commerce, the Banking Moving Forward study by Experian reveals that a third of the UK population believes that credit or debit card payments will no longer be the preferred method of payment in 2020 and that paying with smartphones will take over.

Continuing this increasing trend of mobile shopping, a study by Paypal and Ipsos has revealed that mobile shopping is growing at nearly four times the rate of overall online spending in the UK and is poised to overtake traditional online shopping. They predict that mobile spend will grow at a rate of 36% from 2013 to 2016, while overall online spend will grow by 10%. Smartphone shopping only accounts for 8% of online spend, while shopping on tablets accounts for only 6%. In comparison, laptops, desktops and notebooks together account for 86% of all online shopping.

Having been the topic of many discussions over the last year, and still rearing its head in the national press, recovery on the high street still "hangs in the balance" as a huge number of town centre leases approach expiry in the next few years, Deloitte has warned. Shop vacancy rates in the North were more than twice those in the South and the situation looks likely to be exacerbated by the vast number of leases that are scheduled to expire by the end of the decade with little prospect of renewal.

The latest British Retail Consortium and Springboard footfall monitor show that Britain’s high streets suffered a 1.6% fall in footfall in January as shoppers continued to turn to out-of-town locations, which increased by 1.5% compared to the same period a year ago. Shopping centre footfall also fell by 2.6%. The BRC said the rise was a sign of "strong" consumer confidence, as it suggested that more consumers were happier to splash out on big ticket items, particularly furniture, and is evidenced by a five point rise in GfK’s UK Consumer Confidence Index.

|

|

|

|

Retail Update - September 2014 |

| |

Posted At: 18 September 2014 15:00 PM

Related Categories: Retail, Retail Statistics, Town & Shopping Centre Management |

| |

One high-profile administration has been recorded on SnapShop since our last update –Phones 4U. Having lost a key contract with EE, soon after losing one with Vodafone, and despite being a profitable business, with turnover of £1bn and underlying profits of £105m in 2013, Phones 4U says without the contracts from the phone networks it can no longer operate. All 550 stores have closed.

The ongoing debate surrounding the future of Great Britain’s high streets has taken a new turn, with a group of property experts within the Government’s Future High Streets Forum looking to pilot a town centre collective ownership scheme among landlords. The aim is to tackle the issue of fragmented ownership on the high street, which had made it difficult to implement a single cohesive strategy to improve town centres and has been highlighted as a barrier. The parties are attempting to raise around £50,000 to pilot the different ideas in two to three UK town centres, such as a London suburb, a northern town centre and a small market town.

Britain's shop vacancy rate has fallen to its lowest level since June 2010 according to Local Data Company figures, which reveal that the shop vacancy rate in August fell to 13.3%, down from 13.4% in July. This is in contrast to the leisure industry which has seen its vacancy rate increase by 0.05% to 7.7% during the month.

Shopping centre investment volumes are on track to surpass the record levels seen in 2013. Figures from CBRE show that some £3.1bn of shopping centres has been sold so far this year, comfortably exceeding the £2.7bn transacted during Q1-Q3 2013. With a further £700,000 of malls currently under offer, Q1-Q3 2014 looks set to far exceed the transaction volumes witnessed in the same period last year and moves closer to the £4.2bn transacted in 2013.

Online sales of non-food products recorded their fastest growth rate in August since the BRC-KPMG Online Retail Sales Monitor started in December 2012, growing at 19.8% when compared to August 2013. Research from Mintel backs this trend up, predicting that the UK online fashion market is expected to be worth £10bn this year. E-commerce is seeing a strong growth in sales as consumers prefer to shop on line - 17% of online spending is on clothing and footwear, up from 13% in 2011.

Interesting research from Savills reveals that new international fashion entrants have accounted for nearly half of all openings in London to date this year. Savills reports there have been 12 new international retail entrants in the London market so far this year, with a further 11 due to open by the end of the year.

|

|

|

|

Retail Update - August 2014 |

| |

Posted At: 21 August 2014 12:34 PM

Related Categories: Retail, Retail Statistics, Retailers |

| |

Since our last update, no administrations were reported.

US leisure operator Entrepology is bringing its extreme indoor trampoline parks to the UK with a roll-out across all major cities. It has a mandate to bring the concept, called High Heaven, to 12 sites across the country. The first UK centre will open in Glasgow, where Entrepology is currently fitting out a 30,000sqft building, later this year.

According to GfK’s Consumer Confidence Barometer, consumer confidence has fallen for the first time in six months in July. Overall index score decreased by three points to -2 after crossing into positive territory for the first time in nearly ten years in June

Some interesting points have been raised over the past month in the retail property industry, and include:

-

UK high streets are getting less and less empty as the economic recovery continues, even as fewer shoppers actually head for shops. The BRC and Springboard have revealed that the vacancy rate in UK town centres had dropped to just 10.1% in July.

-

On the other hand CACI research shows that more than a quarter of the UK is oversupplied with retail space, yet more is being developed. CACI said oversupply would rise to 37% by 2019, with a further 32m sq ft of space across 187 sites set to come online by 2020.

-

The amount of new supermarket space proposed for the UK has fallen to the lowest level since September 2008, according to CBRE. The amount of new space under construction for convenience stores and out-of-town supermarkets has also fallen 30% YoY.

The biggest spending tourists in the UK are from the Middle East - according to Global Blue. Last year, visitors from Qatar topped the list by spending an average of £288.17 on each trip to the till. This was followed by £199.87 spent by visitors from Saudi Arabia, £188.29 by UAE visitors and £189.41 by visitors from Bahrain. In comparison, the average European tourist, making up the bulk of visitors to the UK, spent just £49 per sale in the same period last year, whilst US visitors spent £65.41.

We recently posted an update on changing face of tourism and to us it appears that designer labels and high-end retail have become the new staple shopping items for tourists to take back home and show off to their friends and family. Visit Britain found that while Middle Eastern visitors want cutting edge fashion, they are not as interested in buying British food and drink

|

|

|

|

SnapShop Monthly Summary - May 2014 |

| |

Posted At: 22 May 2014 15:49 PM

Related Categories: Administrations, Retail Statistics |

| |

Consumer confidence continues to improve, as evidenced with a 6.2% rise in UK retail sales during April according to ONS figures, in which some £28bn was spent over the course of the month. UK online sales grew by 13.3%, suggesting that the wider consumer recovery remains on track. The rise in sales comes after a footfall decline of 0.1%.

There were no reported administrations on SnapShop during May, however administrators at Internacionale have confirmed the business will be wound down. It’s a similar story at Paul Simon, where administrators have announced that the remaining stores will close by mid-June following a restricted level of interest from potential purchasers.

On a brighter note, Hereford’s 310,000sqft Old Market scheme opened its doors at the beginning of May. Old Market is the only significant retail development to open this year, and is the first major development in Hereford for 25 years.

Annual spending by overseas visitors is predicted to grow by 34% to over £27bn by 2017 in the UK, according to The Tourist Dynamics report from Barclays, indicating the resilience of the luxury goods market in the UK.

The continuing expansion of multiple operators and symbol groups in the convenience sector has led to a new analysis of the market being carried out by IGD and WRBM, the results of which reveal that the sector is expected to grow by more than 30% over the next five years, generating an additional £12bn in extra sales.

Finally, the BRC continues in its battle to tackle the issue of business rates, joining forces with representatives from the leisure sector and other high street businesses and manufacturers to strengthen its calls for the Government to reform the system. The BRC will publish the next phase of its work on business rates at the end of June.

|

|

|

|

SnapShop Monthly Summary - February 2014 |

| |

Posted At: 25 February 2014 13:11 PM

Related Categories: Retail, Retail Statistics |

| |

This month’s statistics show an improving trend on the UK’s embattled high streets.

• BDO’s High Street Sales Tracker show that like-for-like high street sales were up 8% for the four weeks to 26 January, the highest figure in three years

• BRC figures show that UK retail sales were up 3.9% on a like-for-like basis from January 2013. On a total basis, sales were up 5.4%, the strongest growth since March 2010

• Shop vacancy rates fell below 14% for the first time in four years according to LDC, although the North West still has the highest rate at 17.3% compared to the national average of 12.2%

• Footfall was up 1.6% in January according to the BRC. Despite a 0.6% decline on the high street, retail park footfall surged 5.7% and shopping centres saw a year-on-year increase of 2.4%

• January online sales grew by 18% compared to the same time last year as shoppers spent £8.1bn over the internet, according to IMRG figures.

• Consumer Confidence, measured by GfK is standing at -7, higher than it has been since September 2007

Another high street rescue plan has been unveiled by the government based on the “common factors of success”. It will be piloted from May across nine town centres, the locations of which will be revealed in the near future.

The BRC have come up with three radical alternatives to business rates, set out in a document called The Road to Reform. They suggest replacing them with a new tax based on business’ energy efficiency; doing away with the current property-based system in favour of a scheme that reduces rates for businesses employing larger numbers of staff; and the suggestion of a discounted rates bills for those paying the most in Corporation Tax.

A separate study by Deloitte found nearly three-quarters of the money spent shopping in Britain comes from just 18% of consumers, who increasingly make their purchases using mobile devices. The ‘Super Shoppers’ account for 70% of all UK retail spending, the equivalent of over £200bn in 2013, despite making up less than a fifth of the population.

February laid claim to one administration - Base Retail, which trades as Base Menswear, appointed restructuring firm Portland as administrator early in the month, citing a squeeze in middle-market menswear and excessive business rates. However, the demise of the menswear business has not affected Base Childrenswear, which is registered as a separate entity on Companies House.

Internacionale UK has filed a notice of intention to appoint PricewaterhouseCoopers as administrator before the end of the month. Keep up to date with this on SnapShop.

|

|

|

|

SnapShop Monthly Summary - January 2014 |

| |

Posted At: 21 January 2014 11:33 AM

Related Categories: Retail, Retail Statistics |

| |

December statistics show that Christmas 2013 wasn’t all that it was expected to be, but at the same time wasn’t as gloomy as some had thought.

• Figures from the Office for National Statistics (ONS) show that year-on-year sales volumes were up 5.3% in December, and up 1.6% for the whole of 2013 when compared to full year 2012. Shopper spend was up 6.1% in December compared to the previous year, and up 2.6% on November.

• The BRC/KPMG Online Retail Sales Monitor for December 2013 shows that online sales accounted for 18.6% of all non-food retail sales and that as a whole, online sales for the month were up 19.2% on the previous year. Consequently it is not surprising that December 2013 saw a 2.4% fall in shopper numbers for the month as recorded by the BRC/Springboard Footfall Monitor for December 2013. The monitor revealed that the high street suffered the greatest fall of 3.7%, with out-of-town shoppers falling 0.6% and shopping centres declining by 1.5%.

• London’s West End outperformed the rest of the UK over Christmas, recording a year-on-year sales increase of 10% in December.

• Garden centres recorded an impressive festive season with sales up 12.5% in November and 5.9% in December, according to the Garden Centre Association’s Barometer of Trade.

• St Pancras International reported that the festive trading period produced solid results in a wide range of categories for retailers. Strong performing categories were: Pubs and Restaurants – up 11% on a like-for-like basis; Fashion – up 3% on a like-for-like basis; Non-Fashion – up 6.8% on a like-for-like basis; Coffee Shops - up 7% on a like-for-like basis; and Convenience Retail – up 2.5% on a like-for-like basis.

• Figures from the Coffer Peach Business Tracker reveal that the UK’s leading pub, bar and restaurant groups enjoyed a festive season boost, with collective like-for-like sales up 3.3% on last year. Total sales were ahead 6.1%.

There have been no reported administrations on SnapShop since the beginning of 2014, and indeed the number of retail administrations during 2013 fell from 194 in 2012 to 183 – the same number as in 2011 – according to Deloitte, representing a 6% decrease.

In other news, research by the Royal Mail has found that just over 40% of small online-only businesses said they would seek space in a physical store – or even open their own – during 2014, with one in 10 UK “e-tailers” saying they hoped to set up physical stores some time in 2014, as lower rents and flexible leases, coupled with more competition online, made opening a physical store more attractive.

Perhaps high street vacancy rates will continue to decline should these online-only retailers decided to take up physical space, or perhaps empty shop numbers will continue to rise when the traditional long leases signed by retailers in the 1980s and 1990s come to an end in 2015 – IPD figures show that 43% of shopping centre retail leases and 37% of all high street shop leases are due to expire within the next two years. Whatever happens, keep up-to-date with it all on SnapShop, and remember that FSP’s Leasing Support can help.

|

|

|

|

Retail Update - November 2013 |

| |

Posted At: 14 November 2013 16:13 PM

Related Categories: Administrations, Retail, Retail Property, Retail Statistics, Retailers |

| |

In spite of what seems to be a gradual recovery in the UK retail market, with shopping centre landlords planning extensions and refurbishments to their portfolios, retailers announcing ambitious growth plans both for the UK and abroad, and international retailers making their debuts in the UK – J Crew, Carven - November saw the demise of two high street names - Blockbuster and Barratts.

In the news:

• Blockbuster appointed Morrfields Corporate Recovery as it collapsed into administration for the second time in year. Failure to reach a licensing agreement with its former parent in the US hampered plans for a new digital platform to enable Blockbuster to compete in the online market. Despite the initial expectation that all stores would continue trading, 72 stores are now earmarked to close.

• Duff & Phelps were appointed as administrator to Barratts, as the footwear retailer succumbed to difficult high street trading conditions for the third time since 2009. Barratts had been looking to secure an emergency loan to help pay for stock in the run-up to Christmas prior to appointing administrators. It is hoped the business can be sold as a going concern, although store closures and redundancies have not been ruled out.

• Abercrombie & Fitch have announced that it is to close its standalone Gilly Hicks stores, including its five UK stores, in relation to its long-term strategic review. The Gilly Hicks brand will still be available to buy in Hollister stores and online.

• Cinemas are becoming an increasingly popular anchor for smaller, mixed-use developments as retail demand stalled in the last few years. Cushman & Wakefield have predicted that 60 new cinemas will open between 2014 and 2017. (Read More)

• Bicester Village has retained its ranking as Europe’s most productive outlet scheme according to the rankings from Magdus. Bicester Village has held this status since 2008.

• Online sales continue to grow month-on-month. Monday December 2 has been predicted to the busiest shopping day in the run up to Christmas 2013 according to IMRG Capgemini e-Retail sales Index, kick-starting two weeks of high sales that will help take online sales for the month of December to £10.8bn. The analysis also suggests that spending in the nine weeks covering November and December will hit £20.4bn.

November signals the beginning of the festive season, with retailers’ airing their TV ads and launching their range of festive treats in-store as they fight to win shopper spend. What remains to be seen though is the result of these campaigns and if they actually make a noticeable difference in the battle for shopper spend over the crucial Christmas trading period. Keep up-to-date with all things festive, and how the retailers fare, on SnapShop.

You can also register to receive SnapShop Monthly free for 3 months.

|

|

|

|

Retail Update - June 2013 |

| |

Posted At: 20 June 2013 11:16 AM

Related Categories: Retail, Retail Statistics |

| |

Although June has seen no reported administrations, the future of a number of high-street brands is hanging in the balance.

• Up to 20 Republic stores face closure after the proportion of landlords willing to agree to the new, softer terms proposed by new owner Mike Ashley’s Sport Direct fell short of the 75% stipulated by the group. As a result, Republic’s outlet in The Lanes shopping centre in Carlisle is to close before the end of the month. The whole chain could still be closed.

• Embattled furniture retailer Dwell has lined up Duff & Phelps as administrator after appointing advisers to explore options for the chain, which includes a pre-pack administration and would continue the on-going demise of the high street.

• Jane Shilton’s future is also in jeopardy after takeover talks with Shoon collapsed following heated discussions between the two parties and a difficult year for the footwear industry as a whole. Jane Shilton made a pre-tax loss of £1.9m for the year to 30 June 2012, and followed the previous year’s loss of £575,000.

Following the administration of Coggles in May, it has been confirmed that the Hut Group has completed its acquisition of the company’s assets including its stock and all intellectual property. As a result, all stores have been closed as Coggles will now continue as an online-only operation within the group’s portfolio.

The iconic King’s Road Sporting Club is to close its doors after 20 years of trading, although reasons behind its as-yet-unknown closure date are unclear. It is believed to still be making a profit, and is understood that the freeholders of the property are behind the decision.

In other news, shopping centre developments throughout the UK are restarting for the first time since the collapse of Lehman Brothers, having been previously frozen amid fears that the economic conditions would dampen demand from retailers. Projects in Glasgow, Leeds, Bracknell and Bradford look set to get off the ground having signed up anchor tenants to their schemes. A total of 40% of the development pipeline is to happen in the London area, with the Battersea Power Station development finally beginning, and the redevelopment of Croydon’s Whitgift centre. Developments at Wembley, Earls Court and King’s Cross are also underway.

And finally, Bill Grimsey has launched his own alternative review of Britain’s troubled high streets after accusing Mary Portas of giving ‘false hope’. He has assembled a team, endorsed by Asda chief executive Andy Clarke, which includes Nick Hood from Company Watch, retail commentator Paul Turner Mitchell, and LDC’s Matthew Hopkinson. The report will be submitted to the three main political parties in the autumn.

|

|

|

|

Retail Update - April 2013 |

| |

Posted At: 18 April 2013 10:58 AM

Related Categories: Retail, Retail Statistics, Retailers |

| |

April has been quite quiet in terms of administrations, with only one reported that was expected. After filing its notice of intention to appoint administrators last month, Lucas Johnson was appointed to Textiles Direct after turnover declined by 20% over the past 12 months. Five stores were closed immediately, but the rest of the business continues to trade while a buyer is sought. Several expressions of interest have been received. The online business continues to trade as a separate entity and is unaffected by the administration.

One of the biggest stories in April was Hilco completing its acquisition of HMV from administrators Deloitte, saving 141 stores from closure. However, just days after HMV was rescued Hilco announced more job losses and threatened further store closures if rental reductions can’t be agreed with landlords.

Struggling up-for-sale Scottish footwear chain DE Shoes has sold five of its 31 stores to Begg Shoes and Bags, with a decision on the future of the rest of the company expected before the end of the month.

WHSmith announced it had acquired the Past Times brand from administrators Duff & Phelps, with plans to use it in a similar way to the Gadgetshop brand it acquired in 2010.

LA retailer BCBG Max Azria and sister brand Herve Leger have announced plans to open shops and concessions throughout London over the next two years, and will also look to open some designer outlet stores.

Swarovski announced strategic plans for its new Cadenza concept in the UK, which offers pieces from designers including Valentino, Roberto Cavalli and Versace, with the opening of four London stores by the end of 2013. A site in Westfield Stratford City has been secured.

Starbucks has become the UK’s first major operator to sign itself up to the concept of suspended coffees, with other coffee chains welcoming the idea.

M&S opened its very first standalone café concept at its Paddington, London, headquarters for both its staff and the public.

A total of 13 shopping centres worth £1.3bn were sold in the first quarter of 2013, representing a 169% increase on the same period in 2012, according to Knight Frank’s latest UK Shopping Centre Investment report. 11 shopping centres worth over £500m are currently being marketed, with another seven currently under offer, representing over £2.3bn.

Research from Santander has shown that some 72% of UK shoppers now regularly buy clothing and accessories from supermarkets, with 16% using supermarkets as a one-stop shop for all food and non-food items. This supports research from Kantar Worldpanel which shows that spending on branded young fashion fell by 5.1% in the under-25s category in the 24 weeks to February 13, as buying habits shift towards cheaper own-label alternatives. Menswear saw the largest decline of 11%, while womenswear fell by 2%.

|

|

|

|

Retail Update - March 2013 |

| |

Posted At: 21 March 2013 10:12 AM

Related Categories: Retail Statistics, Retailers |

| |

The much-anticipated Trinity Leeds shopping centre opens its doors today, 21st March, with over 120 stores, bars and restaurants. The centre has been designed to be one of the most digitally advanced shopping centres in the UK with free wi-fi, assistants with internet-connected iPads and large video walls operated by gesture recognition.

Otherwise, March has been a fairly quiet month with no reported administrations. Textiles Direct has, however, filed a notice to appoint administrators although this has yet to materialise.

Adding new product categories and formats is a way to differentiate from the rest of the high street. Burberry and Dior have announced plans to expand their luxury offerings in the UK with the opening of standalone beauty boutiques for their perfume and cosmetics collections on the back of the success of Chanel’s first beauty boutique in London’s Covent Garden.

Aurora Fashions has announced a big shake-up of its operations, splitting out Coast from the wider group and rebranding to Fresh Channel, over the next 12-18 months.

Waitrose has announced it is to open gardening shops outside 41 of its stores, and Next is to expand its Home & Garden format with the opening of its third outlet in Camberley.

Bluewater reported strong trading in February with a 6.7% rise in sales across its retailers, outstripping the increase delivered across the whole of the retail sector in February.

February’s online sales increased 13% year-on-year according to the IMRG Capgemini e-Retail Sales Index, with nearly all sectors reporting double-digit growth. Average spend, however, hit its lowest levels since October 2008. IMRG predicts that UK cross-border e-tail sales will reach £10bn during 2013, with sales across Europe predicted to reach €36bn.

A new report compiled by the New West End Company and Heart of London Business Alliance expects London’s West End spending to surge 25% to £12.5bn driven by Asian and US tourist shopping in the area.

|

|

|

|

Retail Update - January 2013 |

| |

Posted At: 18 January 2013 00:00 AM

Related Categories: General, Retail, Retail Statistics, Retailers |

| |

Statistics for December look promising with overall shop price inflation remaining at 1.5% for the third consecutive month according to the BRC Nielsen Shop Price Index. BRC’s Retail Sales Monitor showed a 1.5% increase in spending in December compared to the prior year. Designer outlet Cheshire Oaks reported Boxing Day 2012 was its best day of trading in its 18-year history.

December’s online sales rose 17.5% with the sector forecast to grow a further 12% during 2013 according to the IMRG Capgemini Index. UK shop vacancy rates dropped by 0.1% in November according to the Local Data Company. Shopping centres including Westfield London, Westfield Stratford and thecentre:MK all saw significantly increased footfall over the Christmas trading period reflecting an increase in consumer confidence.

Westfield and Hammerson have finally settled their long-standing Croydon dispute, agreeing to collaborate on the scheme.

Three administrations have been reported since the beginning of 2013, following in Comet’s footsteps. Jessops failed to generate the profits it required to viably continue trading and has resulted in all 192 UK stores being closed. HMV was placed into administration after talks with its lenders failed to reach a successful outcome. A number of potential buyers have registered their interest in the chain and all stores continue to trade while a buyer is sough. Blockbuster appointed Deloitte as administrator after increased competition from internet-based providers impacted its trading. Its core business is still profitable and it will continue trading while a buyer is sought.

In news relating to UK market entrants, H&M will debut its &Other Stories concept on London’s Regent Street in the spring, Saffran will open its debut UK outlet at Manchester’s Trafford Centre, Greek jeweller Li-La-Lo opened its debut store in December at Westfield London and Microsoft is looking to open high street stores in the UK in a bid to take on Apple.

|

|

|

|

Retail Insolvencies in Q2 2011 |

| |

Posted At: 28 July 2011 15:00 PM

Related Categories: Administrations, Retail Statistics, Retailers, Store Closures |

| |

According to recent report by PwC, the number of UK Company insolvencies fell in the second quarter but warned that corporate failures could rise in some sectors as consumer spending remains weak.

In total, 3,531 UK companies became insolvent in the second quarter, a 16% decline from the 4,216 failures in the first three months of the year, according to an analysis by PwC.

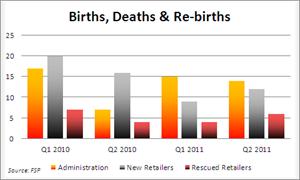

Some of the administrations noted on SnapShop for first half of 2011 were long-established high street chains such as Oddbins, Moben, Dolphin, Focus DIY, Habitat and Jane Norman, as well as some newer names like Georgina Goodman and Life & Style. Over the previous quarter, the number of retail administrations has gone down by 7% in second quarter of 2011 compared to first quarter of 2011 - a significant number of them were household names.

At the same time it was interesting to know that number of new retailers entering UK have increased by nearly 33% in Q2 2011compared to Q1 2011 along with an increase in number of retailers rescued in Q2 2011 compared to that in Q1 2011.

We were asked, if this is because landlords are working harder to help retailers? Well, yes and no. Landlords are well aware there aren’t too many retailers knocking on their doors. And some rent is often better than nothing also as Q2 takes in the period after the retail doldrums of February and March. Retailers having survived Q1, hope for better times. But Midsummer Quarter Day, rent day for the Third Quarter, is a day of reckoning.

Alongside this there was an affirmative research published by LDC showing no change from the occupancy level seen at the beginning of 2011, LDC suggests this is due to regional variations and a high volume of betting shops, supermarkets and charity shops opening across the country, and it also points to an improvement in the opening of independent stores.

Do you need to keep up-to-date with these trends and statistics? Please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

|

|

|

|

The discretionary use of cars |

| |

Posted At: 25 March 2011 12:20 PM

Related Categories: Retail Statistics |

| |

ONS published their Retail Sales figures for February yesterday. SnapShop always has a look and comments on the Value of Retail Sales, particularly the differentiation between Food and Non-Food stores. We usually focus more on Value, than Volume – after all, what we’re having to pay is what we’re having to pay – and we usually ignore the column on Automotive Fuel. However, yesterday’s figures raised an interesting point, particularly in the light of the Budget concession on petrol prices. One expects the Value of Automotive Fuel to have increased (it has, substantially, with a year-on-year increase of 18.7%), but it is interesting that the Volume of Automotive Fuel sold in February increased Year on Year by 3.2%. Shouldn’t we all be using our cars less?

The 3 month moving average for Automotive Fuel has dropped every month since early 2008. However, the February Year on Year upturn followed an even larger, 6.5%, Year on Year increase in January. Perhaps a turning point has been reached, driven either by an upturn in the economy, so far unrecognised elsewhere, or that the discretionary use of cars has now reached a new, lower level. From personal experience, it seems that public transport, particularly trains, and the use of bicycles, particularly in London, have both increased over the last 3 years.

With Volume and Value both increasing, and despite the nod to the situation by Mr Osborne (albeit obliterated at the pumps by a pre-emptive strike by petrol companies) the government will be raking it in, which will be good news for the non-car drivers.

|

|

|

|

Basket of Goods |

| |

Posted At: 16 March 2010 10:17 AM

Related Categories: Retail Statistics, Social Commentary |

| |

ONS have just released the CPI/RPI Basket of Goods and Services update for 2010, and though it may not look too interesting on the face of it (unless stats are your thing), it becomes a fascinating read when you trawl back through the archives and consider the influence of outside factors on our buying decisions.

From what I remember of 2009, it wasn’t a great year. There were bushfires, earthquakes, tsunamis and an economic meltdown, and it was a spectacularly bad year for music and film fans, with the deaths of Michael Jackson, Les Paul, Patrick Swayze, Brittany Murphy & Farrah Fawcett to name but a few.

But did this have an effect on what we purchased?

Favourites such as garlic bread, liquid soap, cereal bars and hair straighteners have been added to the basket product list, while pitta and squash court hire have been removed. It looks to me like we were struck with a case of the ‘why waste your time on the squash court when there is so much life to be out there living’?

Of course I don’t know if this is the case, but personally, disasters such as earthquakes and tsunami’s make me realise how precious life is, and that frankly, I’d rather be out there enjoying myself rather than worrying about how healthy my diet is or how I’ve missed one of my twelve sessions in the gym this week. So yes, I’d much rather have some garlic bread than dealing with rubbish dry pitta, thanks!

And if you look back to 2003? Pot noodles, slim fast and Ikea bookshelves were the order of the day, while electronic keyboards, tinned spaghetti and vinyl floor coverings were no longer en vogue!

See, fascinating!

|

|

|

|

Basket of Goods |

| |

Posted At: 16 March 2010 10:17 AM

Related Categories: Retail Statistics, Social Commentary |

| |

ONS have just released the CPI/RPI Basket of Goods and Services update for 2010, and though it may not look too interesting on the face of it (unless stats are your thing), it becomes a fascinating read when you trawl back through the archives and consider the influence of outside factors on our buying decisions.

From what I remember of 2009, it wasn’t a great year. There were bushfires, earthquakes, tsunamis and an economic meltdown, and it was a spectacularly bad year for music and film fans, with the deaths of Michael Jackson, Les Paul, Patrick Swayze, Brittany Murphy & Farrah Fawcett to name but a few.

But did this have an effect on what we purchased?

Favourites such as garlic bread, liquid soap, cereal bars and hair straighteners have been added to the basket product list, while pitta and squash court hire have been removed. It looks to me like we were struck with a case of the ‘why waste your time on the squash court when there is so much life to be out there living’?

Of course I don’t know if this is the case, but personally, disasters such as earthquakes and tsunami’s make me realise how precious life is, and that frankly, I’d rather be out there enjoying myself rather than worrying about how healthy my diet is or how I’ve missed one of my twelve sessions in the gym this week. So yes, I’d much rather have some garlic bread than dealing with rubbish dry pitta, thanks!

And if you look back to 2003? Pot noodles, slim fast and Ikea bookshelves were the order of the day, while electronic keyboards, tinned spaghetti and vinyl floor coverings were no longer en vogue!

See, fascinating!

|

|

|

|

Christmas Sales Report |

| |

Posted At: 08 January 2010 11:58 AM

Related Categories: Retail Statistics, Retailers |

| |

The first round-up of our reported Christmas Sales was issued today, showing positive increases across all sectors for which results have been issued.

The clear leader this year as well as last, was clothing and footwear. Supergroup, parent of ‘now’ brands Superdry and Cult Clothing, have reported the best results so far, at almost a 30% LfL increase.

Online also performed well, with Dominos, M&S, Ocado and Shop Direct Group (operators of woolworths.co.uk) all reporting over 15% total sales change for the Christmas period.

To view the SnapShop Christmas Sales Report, click on the Newsletters tab from the menu bar logged when logged into SnapShop, or sign up to SnapShop FreeZone to get access to this report, and the next 3 updates.

|

|

|

|

The Bells, The Bells!! |

| |

Posted At: 08 June 2009 14:51 PM

Related Categories: Retail Statistics |

| |

No the retailers have not started early for Christmas this year and no this is not the death knell sounding again for yet more ghastly economy news! What I would like to discuss today is weddings!

We all love a good wedding don’t we…or do we? As I have noticed (yes I have got to ‘that age’) more and more of my friends are heading down the aisle, and while we all know that they’re costly occasions, research suggests that Bridezillas are not about to let a little thing like a recession get in the way of their big day! In fact, because marriages are more often than not saved for and planned in advance, the wedding sector of the retail market has yet to be affected by the aforementioned woes. And in June last year it was reported that the cost of weddings was still on the increase.

The Telegraph reported on findings from You and Your Wedding – which has been monitoring the cost of ceremonies for over 12 years - that the average price totaled £20,273, compared with just £14,643 five years before, in 2003. It is believed that this year’s figure will top £21,000, but it’s not just a cost to the bridge and groom (of their parents)…these days, we all have to fork out! Let’s look at the cost of weddings from a guest’s point of view first: ~

As reported by WalletPop UK, a survey conducted by Halifax last month revealed it costs on average over £600 pounds to attend a wedding. The top 5 items we spend on are listed below:

1. An outfit for the big day (av spend £123)

2. Present for the happy couple

3. Accommodation near the venue if is not local (circa £109)

4. The Hen or Stag Party

5. Reception drinks